Can You Short Altcoins?

When it comes to Short altcoins, there are a lot of different options out there. In fact, there are over 4,000 different altcoins in existence today. With so many options available, it can be tough to know where to start. That’s why we’ve put together this guide on altcoins.

We’ll give you a brief Introduction of altcoins are and how they work. Then, we’ll provide an overview of some of the most popular altcoins on the market today. By the end of this guide, you should have a good understanding of what altcoins are and how they can be traded.

What is Short Selling?

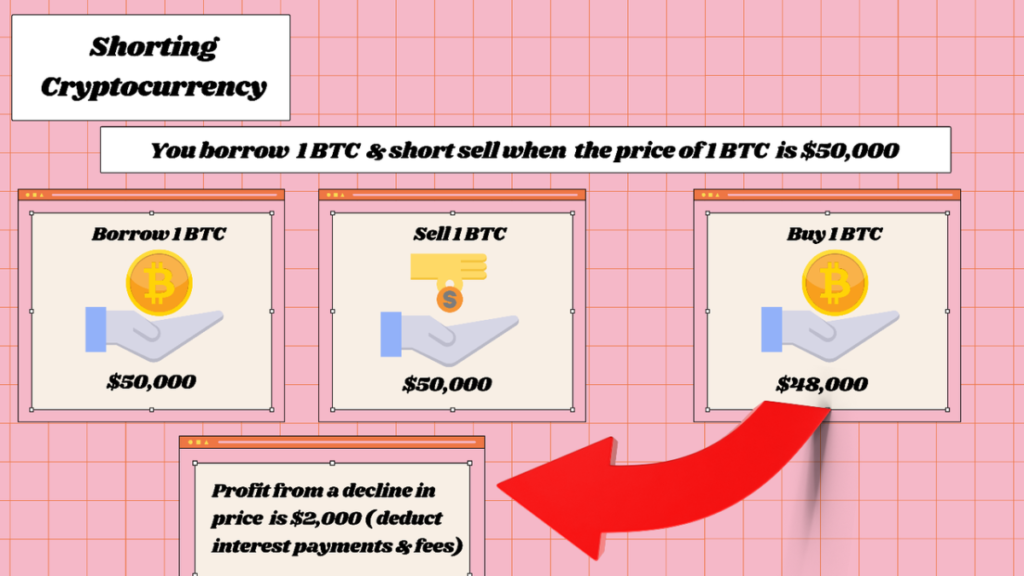

Short selling is the process of borrowing an asset from a lender, selling it, and then buying it back at a lower price in order to return it to the lender. It is typically used in order to take advantage of falling prices, but can also be used to hedge against future price declines.

In order to short an asset, you first need to find a willing lender. This can be done through a number of different platforms, including online brokerages and exchanges. Once you have found a lender, you will need to agree on terms, such as the loan period and interest rate. Once these terms are agreed upon, you will be able to sell the asset.

Once you have sold the asset, you will need to wait for the price to fall before buying it back and returning it to the lender. If the price does not fall within the agreed upon time period, you may be required to pay additional fees or even return the asset at its original price.

Advantages and Disadvantages of Shorting Altcoins

When it comes to altcoins, there are a lot of different opinions out there. Some people are die-hard fans and believe that altcoins are the future of cryptocurrency. Others think that altcoins are nothing more than a passing fad. And then there are those who think that altcoins are a great investment opportunity – either to be bought and held for the long term, or to be traded for profit in the short term.

Here’s a look at the advantages and disadvantages of shorting altcoins:

Advantages:

- The potential for large profits: If you pick the right altcoin and time your trade correctly, you could stand to make a lot of money from shorting it.

- It’s a good way to hedge your bets: If you’re worried about the possibility of a market crash, shorting an altcoin can help offset some of those losses (provided, of course, that the altcoin doesn’t crash harder than the overall market).

Disadvantages:

- It’s risky: There’s no guarantee that an altcoin will go down in value just because you think it will. In fact, it could easily go up in value and leave you

How to Short Altcoins?

In order to short altcoins, you will need to use a cryptocurrency exchange that offers this feature. At the time of writing, some of the exchanges that offer shorting include Bitfinex, Kraken, and Poloniex.

When using these exchanges, you will first need to deposit the cryptocurrency that you wish to short into your account on the exchange. Once it is deposited, you will then need to place a sell order for the currency pair that you wish to short. For example, if you wanted to short Bitcoin Cash (BCH), you would place a sell order for the BCH/USD currency pair.

The price of the currency pair will then be displayed on the order screen. You will need to enter the amount of BCH that you wish to sell and set your desired price. Once your order is placed, it will remain open until it is filled by another user or until you cancel it.

Once your order is filled, the proceeds from the sale will be deposited into your account in USD. If the price of BCH falls as expected, you will make a profit. However, if the price rises instead, you will incur a loss.

Strategies for Successful Shorting

- Do your research: When it comes to shorting altcoins, you need to have a firm understanding of the underlying asset. This means researching the coin’s technology, team, roadmap, and ecosystem. Without this due diligence, you’re essentially gambling.

- Have a plan: Before you start shorting an altcoin, you need to have a clear plan in place. This includes setting your entry and exit points, as well as your profit targets. Having a plan will help you stay disciplined and avoid making emotional decisions.

- Use stop-loss orders: A stop-loss order is an order that automatically sells your position when it reaches a certain price point. This can help limit your losses if the market turns against you.

- Be patient: Shorting an altcoin can be a waiting game. It’s important to be patient and wait for the right opportunity to enter a position. Rushing into a trade often leads to losses.

- Have discipline: Once you’re in a trade, it’s important to stick to your plan and not get emotionally attached to the position. This can be difficult, but it’s crucial for success in altcoin trading.

Alternatives to Shorting Altcoins

There are a few alternatives to shorting altcoins, which may be more suitable depending on your investment goals. These include:

- Going long on altcoins: This means buying and holding altcoins in the hopes that they will appreciate in value over time. This is a more traditional investment strategy and may be more suitable for those with a higher risk tolerance.

- Investing in crypto-related companies: Another way to profit from the rise of cryptocurrencies without directly owning any is to invest in companies that are involved in the space. This could include businesses that develop blockchain technology, operate cryptocurrency exchanges, or provide other services to the industry.

- Hedge your portfolio with futures contracts: For investors who want to protect their portfolios from downside risk, another option is to trade futures contracts. Futures contracts are agreements to buy or sell an asset at a set price at a future date. By buying futures contracts, investors can hedge their portfolios against potential losses if the price of cryptocurrencies were to drop sharply.

Common Mistakes to Avoid When Shorting Altcoins

Many investors are eager to short altcoins in order to profit from the inevitable price decline that follows a hype cycle. However, there are a few common mistakes that many novice traders make when attempting to short altcoins.

One of the most common mistakes is failing to properly research the coin before opening a position. Many altcoins are highly volatile and can be easily manipulated by whales. As such, it is important to have a firm understanding of the coin’s history, team, roadmap, and other relevant factors before entering a trade.

Another mistake that investors often make is not setting proper stop-loss orders. Since altcoins can be highly volatile, it is important to set tight stop-losses to minimize losses in the event of a sharp price movement against your position.

Many traders fail to take into account the impact of fees when shorting altcoins. When you open a short position, you will be charged interest on the borrowed coins. In addition, you will also have to pay trading fees when you exit your position. These fees can eat into your profits, so it is important to factor them into your calculations when planning your trade.

Conclusion

Shorting altcoins can be a great way to make money if you know what you’re doing. It is important to remember that this type of trading involves taking on more risks than other types of investments, so it pays to do your research before getting involved. With the right strategy and risk management, however, shorting altcoins can be an effective way to make money in the crypto market.